With rising costs affecting nearly every aspect of daily life—from transportation to shelter to food—consumers are looking for alternatives that offer better value, and plant-based products are increasingly becoming a preferred choice, a new report found.

Recent findings from the Plant Based Foods Institute (PBFI)’s Migration Analysis reveal a notable shift in consumer preferences towards plant-based products, with key categories outperforming their animal-based counterparts.

Ian Panelo | Pexels

As shoppers increasingly prioritize health, sustainability, and cost-effectiveness, plant-based alternatives are gaining ground in grocery aisles across the country.

Conducted with help from 84.51° data insights, the report used Kroger’s retail data of 7.8 million households who made purchases between January 2022 and December 2023. Its findings provide a detailed look at how the dynamics are changing in plant-based milk, cheese, frozen meals, and other key categories.

Table of Contents

Rising costs push shoppers toward plant-based alternatives

The report highlights that rising costs of animal-based product were the second largest influencer in increased plant-based consumption, with a 9 percent year-over-year increase.

“When it comes to challenges consumers experience with plant-based foods, high price is usually one of the top reasons mentioned,” Linette Kwon, Consumer Insights and Data Analyst at PBFI, tells VegNews.

“However, the past year has demonstrated that when the prices of animal products also go up, shoppers are willing to be flexible and explore more options, including plant-based,” Kwon says.

In 2023, the average retail price of some plant-based categories, such as plant-based butter, seafood, and meat, became comparable or even lower than that of animal-based counterparts. “The average retail price of most plant-based categories is still higher, but the gap appears to be shrinking every year,” Kwon says.

Plant-based butter, seafood, and meat were among those products that had price parity or were cheaper than their animal-based equivalents. “When price is not as large of a barrier, many shoppers may feel more empowered to try plant-based foods and having more options to choose from could help shoppers find the right product for their dietary needs or lifestyles,” Kwon says.

By category: plant-based milk, cheese, and refrigerated meat

One of the most striking findings from the Migration Analysis is the success of key plant-based categories. Plant-based milk, cheese, and refrigerated meat are leading the charge, with consumers increasingly shifting their spending from animal-based versions of these products to plant-based alternatives.

“Shoppers that are either new to, maintaining, or increasing their spend in plant-based categories had the highest engagement with plant-based milk, plant-based cheese, and plant-based refrigerated meat,” Kwon notes.

The report found that 37 percent are consuming more plant-based options than dairy in the milk category; 24 percent are choosing plant-based over animal in the refrigerated meat category; and 18 percent are opting for plant-based over dairy in the cheese category—a figure that has grown by 7 percent since PBFI’s last report.

Impossible Foods

Impossible Foods

Shoppers are also shifting their choices in other parts of the store, such as frozen meat, yogurt, and frozen meals, with 26 percent, 24 percent, and 24 percent, respectively, opting for the plant-based versions over their animal-based counterparts.

Mature shoppers who typically seek out convenience foods are increasingly adding to the category of new plant-based shoppers. These shoppers are less focused on healthy options and more interested in quick meals, which has contributed to the growth of categories like plant-based frozen meals and ready-to-eat options.

Moreover, according to PBFI’s 2023 retail data, categories such as plant-based creamer, protein liquids and powders, and plant-based baked goods have also experienced growth despite the challenging economic environment. Sales of plant-based creamers grew by 11 percent year-over-year, while plant-based protein liquids and powders saw a 9 percent increase.

Califia Farms

Califia Farms

“One potential contributor to the growth of plant-based creamer sales over the past few years could be that following the pandemic, many consumers learned how to make their own coffee at home,” Kwon says. “In addition to coffee, consumers have experimented with other beverages that they could make at home every day such as matcha or chai lattes, which could further boost sales of plant-based creamers.”

Shifting sentiments: health and environmental concerns

The Migration Analysis also sheds light on evolving consumer sentiments regarding plant-based foods. In fact, 48 percent of shoppers cited health concerns as their primary reason for increasing their plant-based purchases, up 7 percent from the previous year. Nearly half (45 percent) are actively seeking to consume less animal products.

From the data, it is clear that health remains the top motivator for shoppers purchasing plant-based products, but the definition of health is expanding.

“We’ve seen health branch out to mean something different to each consumer,” Kwon shares.

Many shoppers are driven by specific health concerns, such as cardiovascular risks, or are looking for nutritional benefits like higher fiber content. With outbreaks of zoonotic diseases, the use of hormones, and antibiotic resistance, 29 percent of shoppers are concerned about the safety of animal products.

Environmental concerns are also driving the shift towards plant-based products. Approximately 30 percent of surveyed households stated that environmental health was a key driver, with many consumers not just focused on general sustainability but also interested in specific features such as sustainable packaging and ethical certifications.

This diverse set of motivators indicates a shift in consumer behavior that is becoming increasingly complex, with each segment looking for products that align with their varying values.

The flexitarian effect: boosting basket size

What’s one way retailers can better serve consumers while simultaneously increasing consumer spending per shopping trip? Julie Emmett, PBFA’s VP of Marketplace Development, explains that optimal merchandising, such as placing plant-based products next to their animal-based counterparts, has been crucial in growing categories like plant-based milk.

Oatly

Oatly

“Providing ample space for product variety and continued innovation in placing products where customers expect to find [them] have helped the plant-based milk category grow to 14.5 percent share of all milk sold in conventional retail and 40 percent in the natural channel,” Emmett tells VegNews.

Moreover, promoting both plant-based and animal-based products together could also benefit sales.

“By promoting both animal and plant-based products together, research shows basket size increases between 38 percent and 77 percent, depending on the category,” Emmett says.

This indicates a growing openness among consumers to mix plant-based and animal-based products—for instance, purchasing plant-based meat with dairy cheese—making the market for plant-based options even more dynamic.

Challenges remain: taste, variety, and convenience

While the shift towards plant-based products is taking shape, certain challenges continue to hinder the adoption of plant-based foods. According to the Migration Analysis, taste is still a significant barrier, with 32 percent of shoppers citing dissatisfaction with the taste of plant-based products as a reason for reducing their spending in the category.

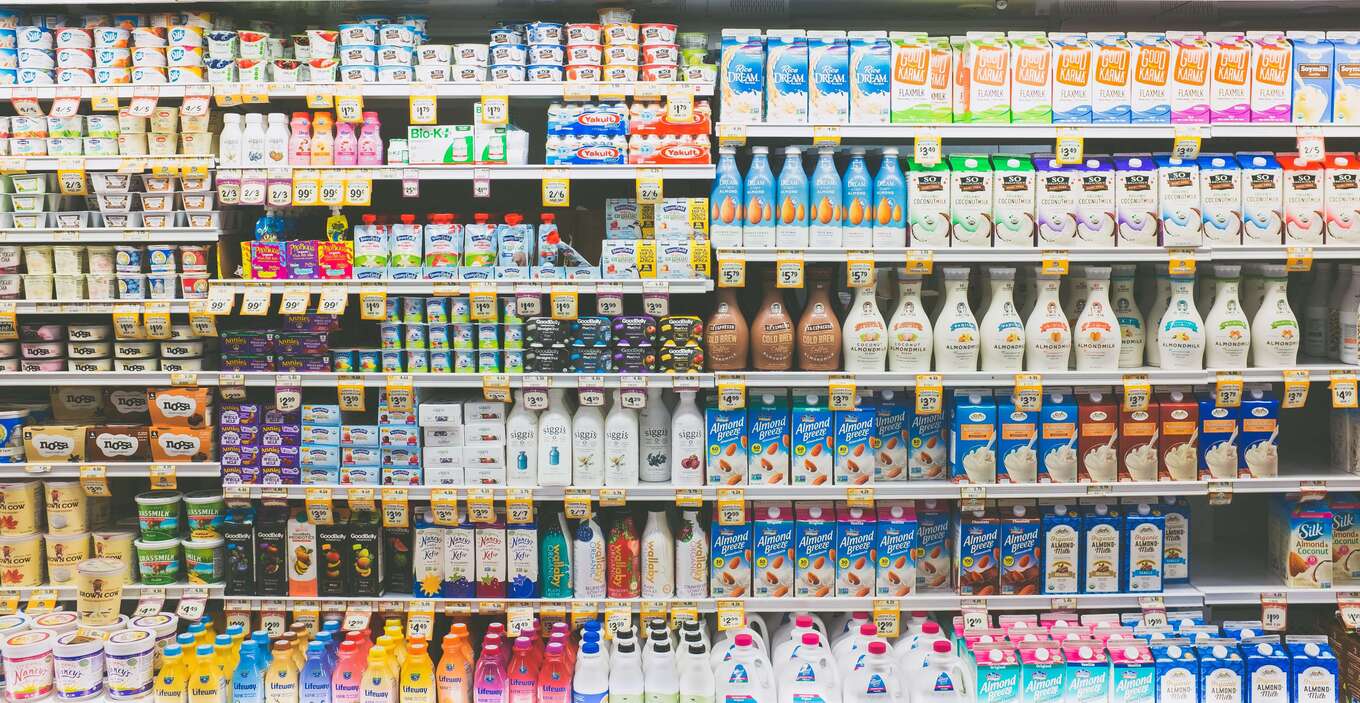

Unsplash

Unsplash

The report also found that 23 percent of households that decreased their plant-based purchases did so because they felt there were fewer plant-based options on shelves compared to animal-based products—a 13 percent increase from the year prior.

Convenience is another concern. Many shoppers who decreased their plant-based spending mentioned difficulty in finding convenient plant-based options, such as ready-to-eat meals. The report highlighted that 16 percent of households decreased their purchases due to the lack of convenient plant-based alternatives—up by 5 percent from 2023.

However consumers continue to cut their overall spending to keep up with the rising cost of living, with 28 percent of shoppers reporting that plant-based foods no longer fit into their budgets.